Knowing your income tax rate can help you calculate your tax liability for unexpected income, retirement planning or investment income. RRSP savings calculator. Canadian corporate tax rates for active business income. How do you calculate marginal tax rate?

How to calculate your effective tax rate? Recommended Articles. Here we discuss the formula of marginal tax rate along with the calculation example and also its advantages and disadvantages.

Use the calculator below to figure out exactly how much you'll be paying a given employee. Select the pay period and filing status, and the calculator will show you how all the required deductions are broken down. Marginal Tax Rate Calculator.

Free for Simple Tax Returns. Much You'll Get Back This Year. Maximum Refund Guaranteed. Get a Jumpstart On Your Taxes! Industry-Specific Deductions. Get Every Dollar You Deserve. File Taxes From Your Home.

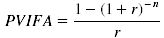

The marginal tax calculator will help you estimate your average tax rate , your current tax bracket, and your marginal tax rate. Our income tax calculator calculates your federal, state and local taxes based on several key inputs: your household income, location, filing status and number of personal exemptions. This calculator sorts through the tax brackets and filing options to calculate your true tax liability. These calculations do not take into account any tax rebates or tax offsets you may be entitled to.

In most cases, your employer will deduct the income tax from your wages and pay it to the ATO. Divide that by your earnings of $80and you get an effective tax rate of 16. The US Tax system is progressive, which means people with higher taxable income pay a higher federal tax rate. Rates are assessed in brackets defined by an upper and lower threshold. The amount of income that falls into a given bracket is taxed at the corresponding rate for that bracket.

Sara has an income of $700 with a marginal rate of. The next highest tax bracket is. If $73is the cutoff for the bracket and this individual. California has among the highest taxes in the nation. Its base sales tax rate of 7. The Golden State fares slightly better where real estate is concerne though.

Access IRS Tax Forms. Complete, Edit or Print Tax Forms Instantly.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.