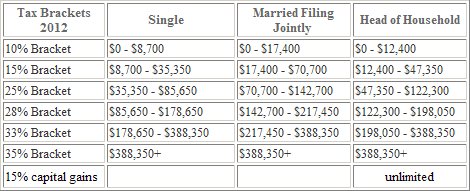

Prevent new tax liens from being imposed on you. Estimate Your Taxes Now. Include your total income, filing status, deductions, and credits. Brush up on the basics with HR Block.

Our free tax calculator is a great way to learn about your tax situation and plan ahead.

File late taxes today with our Maximum Refund Guarantee. This tax calculator is solely an estimation tool and should only be used to estimate your tax liability or refund. It should not be used for any other purpose, such as preparing a federal income tax return , or to estimate anything other than your own personal tax liability. Offer valid for tax preparation fees for new clients only. Access IRS Tax Forms.

Complete, Edit or Print Tax Forms Instantly. This tax refund estimate calculator can give you a great starting point. This up to date tax calculator applies to the last financial year ending on June.

This should be for your current tax return that is due. Be mindful, it is only an estimate, but does calculate the same way as the ATO works out your refund.