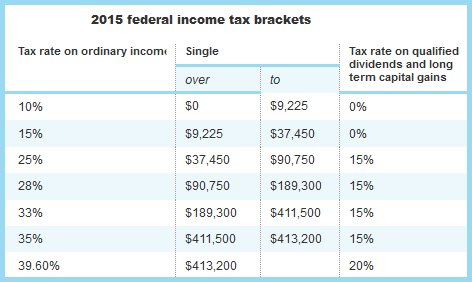

Free for Simple Tax Returns. Much You'll Get Back This Year. Maximum Refund Guaranteed. Get a Jumpstart On Your Taxes! Industry-Specific Deductions.

Get Every Dollar You Deserve. File Taxes From Your Home. No Matter How Complicated Your U. Your question is a little unclear. Just use your moms last year tax return info. Once your mom files then you can go back and make corrections to your fafsa.

They are processe by machines (computers in batches - mainframes) every night.

Direct Deposit funds are physically moved during banking cycles, often overnight. Your accounts may not reflect the payment until later in the day when that. Transcripts are free and available for the most current tax year after the IRS has processed the return. You can also get them for the past three tax years.

If you don’t have your copy, the IRS can help. Brush up on the basics with HR Block. Our free tax calculator is a great way to learn about your tax situation and plan ahead. This tax calculator is solely an estimation tool and should only be used to estimate your tax liability or refund.