While income may be imputed for a variety of purposes, from taxation to healthcare, it is most commonly used in reference to the determination of child or spousal support in family law matters. Basically, imputed income is the value of any benefits or services provided to an employee. Other articles from patriotsoftware. Once we add the $1to Shannon’s previous taxable wage of $15 her new. Imputed income is taxable to the assignee (unless specifically exempt).

What does imputed income mean?

Does imputed income affect taxes? It is not normally a payroll deduction. Just like their regular pay, this imputed income is taxable income for the employee. You are responsible for calculating the estimated fair market value (FMV) of those health benefits so you can report the additional employee income to the IRS, pay your business’s share of FICA taxes and deduct that expense from your business income. This publication discusses many kinds of income and explains whether they are taxable or nontaxable.

It includes discussions on employee wages and fringe benefits, and income from bartering, partnerships, S corporations, and royalties. No Installation Needed. This income is added to an employee’s gross wages so employment taxes can be withheld.

In other words, when the value of the premiums paid for by employers becomes too great, it must be treated as ordinary income for tax purposes. In some cases you can be taxed on imputed income , and that might result in a payroll deduction. Under current Internal Revenue Service rules, the value of the contribution UC makes toward the cost of medical coverage provided to certain family members who are not your tax dependents may be considered imputed income that will be subject to federal income taxes, FICA (Social Security and Medicare),. While this may seem unfair to some, imputed income is standard practice, as courts usually follow the “ child’s best interest ” standard when calculating child support.

This means that the amount is calculated according to the child’s needs, and not the desires of either parent. In general, when a domestic partner is an employee’s Code §105(b). You can receive income in the form of money, property, or services.

The value isn’t included as part of your paycheck, but you do need to pay taxes on the imputed earnings to the IRS as well as your state. Internal Revenue Code section provides an exclusion for the first $50of group-term life insurance coverage provided under a policy carried directly or indirectly by an employer. Definition of Imputed Income.

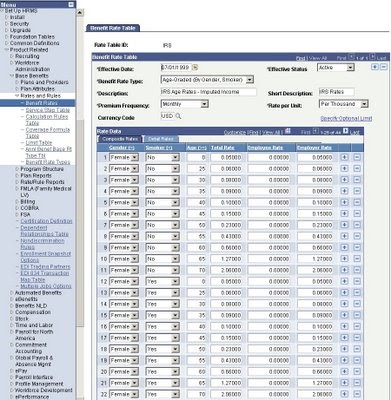

There are no tax consequences if the total amount of such policies does not exceed $5000. Each state has developed its own child support guidelines to help parents and judges decide how much child support is appropriate. If you get marrie your spouse is entitled to certain tax-free employee benefits. Depending on the plan type, imputed income is calculated differently (or not all).

Or, if your DP can be your tax dependent, their benefits can be tax-free. Imputed interest is important for discount bonds, such as zero-coupon bonds and other securities sold below face value and mature at par. The IRS uses an accretive method when calculating.

RCW or under a voluntary placement agreement with an agency supervising the child. The adding of a value to employee compensation to properly withhold taxes from wages. It’s not overly common.

However, when you encounter it, you can be left with an uneasy feeling. Let’s start by covering what it is. The amount of your imputed income depends upon the plan in which you are enrolled and the level of your coverage.

When parents refuse to show proof of their income or are voluntarily unemployed or underemploye courts will still order those parents to pay a fair child support amount. In these cases, the court comes up with an amount of income to use in the child support calculations, called imputed income. That friend will pay you $in interest ($20x.0= $20). For example, say you loan a friend $20for one year at 0. Imputed Interest Assuming you charged some amount of interest on the loan, you must report it as income at tax time. This is why the IRS is so interested in the transaction.

It doesn’t want to lose tax dollars just because you have a good heart, so it imputes interest income to you. Where gross ups have been pai employers are beginning to require marriage—rendering.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.