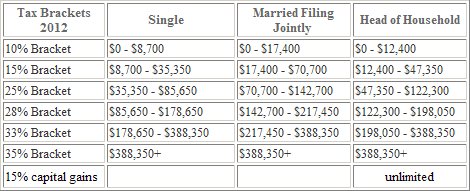

The main purpose of this calculator is to illustrate as simply as possible how marginal tax brackets work. If you are looking for more exact calculations, go to this site. The Tax Foundation is the nation’s leading independent tax policy nonprofit. Tax brackets and the new tax law The Tax Cuts and Jobs Act that went into effect on Jan.

The tax rate would increase to percent on net worth from $to $2million, percent from $2to $5million, percent from $5million to $billion, percent from $to $2.

These brackets are halved for singles. Warren’s wealth tax places a levy on fortunes above $million and a. But he has never suggested that. Sanders has proposed several options to help cover the cost. Did Sanders Propose Raising Taxes to on Incomes Over $2000?

Sanders proposes raising the death tax rate to percent for inheritances. Under the proposal, the death tax would kick in at $3. Currently, the death tax applies to estates over $million and applies a percent rate.

This proposal will increase taxes by $3billion over ten years.