This tax calculator is solely an estimation tool and should only be used to estimate your tax liability or refund. It should not be used for any other purpose, such as preparing a federal income tax return, or to estimate anything other than your own personal tax liability. Think of this as your. Enter your income and location to estimate your tax burden.

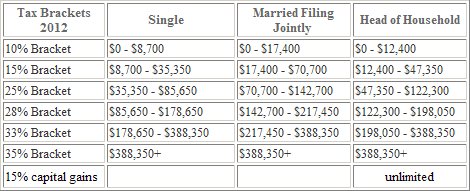

High incomes will pay an extra 3. Net Investment Income Tax as part of the new healthcare law, and be subject to limited deductions and phased-out exemptions (not shown here), in addition to paying a new 39.

How to calculate tax on a certain? What is the best free tax calculator? How do I …calculate my taxable income? This interactive, free tax calculator provides accurate insight into how much you may get back this year or what you may owe before you file. People with more complex tax situations should use the instructions in Publication 50 Tax Withholding and Estimated Tax.

This includes taxpayers who owe alternative minimum tax or certain other taxes, and people with long-term capital gains or qualified dividends. The ATO publish tables and formulas to calculate weekly, fortnightly and monthly PAYG income tax instalments that can vary from the annual tax amounts.