New York has a flat corporate income tax rate of 7. Financial corporations ($1billion in assets) Remaining taxpayers 8. Complete, Edit or Print Tax Forms Instantly. Business Tax Filing Information and the COVID-Outbreak. Tax Tips for the Self-Employed.

Find Out More About Your Taxes! Free for Simple Tax Returns. Maximum Refund Guaranteed. Industry-Specific Deductions. Get Every Dollar You Deserve. However, a lower rate of 5. Calculate your state income tax step by step 6.

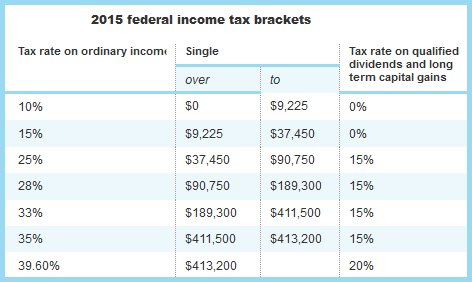

The default tax rate is 6. If you want to simplify payroll tax calculations, you can download ezPaycheck payroll software, which can calculate federal tax , state tax , Medicare tax , Social Security Tax and other taxes for you automatically. You can try it free for days, with no obligation and no credt card needed. These changes include: the sunset of Illinois’ temporary income tax rate hike, with the flat rate reverting from to 3. Indiana’s top rate from 3. Each rate applied to a different range of income. As such, the statutory corporate income tax rate in the United States, including an average of state corporate income taxes, is 25.