What are personal exemptions? Unlike with deductions, the amount of exemptions you can claim does not depend on your expenses. Single filers saw their standard deduction rise from $3to $100 while joint filers got a boost from $17to $2000. Those increases of $6and $13corresponded to the value of just under one and a half personal exemptions for singles and three exemptions for joint filers.

Solved: TurboTax enters for the personal. See all full list on irs. New tax provisions, including a higher standard deduction, may or may not make up for the removal of personal and dependent exemptions , as taxpayers’ situations vary. You are allowed to claim one personal exemption for yourself and one for your spouse (if married).

Most taxpayers can claim one personal exemption for themselves an if marrie one for their spouse. However, if somebody else can list you as a dependent on their tax return, you are not permitted to claim a personal exemption for yourself. However, the exemption is subject to a phase-out that begins with adjusted gross incomes of $265($318for married couples filing jointly). Family income = $100– $17(std deduction) – $22(personal exemptions) x (income tax rate) = $7– $0(child tax credit) = $7tax due. Unlike deductions, the personal exemption was available to all taxpayers, regardless of their expenses.

However, once you turn 6 if you do not itemize your deductions, your standard deduction increases. They no longer allow this. That will take the figure up to $1per person. You cannot claim this exemption for a domestic partner or for your dependents.

Veteran Exemption You can claim an additional $0exemption if you are a military veteran who was honorably discharged or released under honorable circumstances from active duty in the Armed Forces of the United States on or any time before the last day of the tax year. That means a family of four would deduct $12from their taxable income, lowering their tax burden. This deduction was vital for lower- and middle-income Americans, since its value would decrease once a family reached a higher joint income level.

However, keep in mind that the personal exemption phases out. The change has a major effect on both federal tax filers and those who pay state income taxes. You lose at least part of the benefit of your exemptions if your adjusted gross income is more than a certain amount.

A personal exemption is the amount by which is excluded your income for each taxpayer in your household and most dependents. Exempted income is simply not considered a part of your income. When the due date falls on a weekend or holiday, the deadline to file and pay without penalty is extended to the next business day.

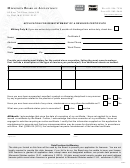

Personal Income Tax Booklet. Heads of household: $350. Single, or married filing separately: $350. The only time that amount changes is if you make a large enough income that the exemption is reduced or removed. The amount of your income that doesn’t get taxed is the standard deduction plus personal exemptions.

Your personal exemptions, $1each, was $1450. An exemption is a dollar amount that can be deducted from an individual’s total income, thereby reducing the taxable income. Trusts and estates (other than bankruptcy estates) do not get a standard deduction.

If you are using Filing Status or the Spouse Tax Adjustment, see the special notes for claiming dependent exemptions.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.