Four to Five: : 3. Sean Williams has no material interest in any companies mentioned in this article. According to the Tax Foundation’s Taxes and Growth Model, the plan would increase federal tax revenue by $1. The main purpose of this calculator is to illustrate as simply as possible how marginal tax brackets work. If you are looking for more exact calculations, go to this site.

The top capital gains tax rate would then fall by about percentage points each year thereafter until it reaches in year six.

But if you are in the marginal tax bracket (income between $413and $46950), then the tax savings on the same $10mortgage interest deduction is $500. So in this scenario, the tax savings would be capped at $800. Clinton would tax estates worth more than $3. Establishes three tax brackets , with rates of , , and. The top rate applies to taxable income over $87for single filers and $142for joint filers.

Increases the standard deduction to $13for single filers and $26for joint filers. The question arose in light of proposal by freshman U. Congresswoman Alexandria Ocasio-Cortez to tax such earners at a rate. The GOP’s hidden tax bracket.

If you’re rich enough, some of your income is taxed at a rate unseen since the ‘80s. Here’s how your take-home pay could be affected if one of them winds up in the. That is going to be the end. A marginal tax rate of does not mean that, for example, a person earning $million would pay $million to the federal government for income taxes. These top-end brackets are , , , and , as you can see above.

Note: This page is a reproduction of the Hillary for America policy proposal on a fair tax system. If you fall into the , , , or ordinary income tax brackets , your capital gains tax is. Currently, a married couple earning $70a year would find themselves in the percent tax bracket.

Under Trump’s tax plan, they could see an increase in each paycheck of more than $10 or as much as $0per year. In addition, it removed the cap on the 2. Medicare payroll tax , raised the corporate tax rate to from ,. Hillary is committed to restoring basic fairness in our tax code and ensuring that the wealthiest Americans and large corporations pay their fair share, while providing tax relief to working families. Bernie Sanders and Elizabeth Warren. The freshman congresswoman last year endorsed raising marginal tax rates on those who make over.

Her proposals would increase revenue by $1. Full List of Obama Tax Hikes. The median income of smokers is just over $30per year.

Hillary has endorsed several tax increases on middle income Americans, despite her pledge not to raise taxes on any American making less than $25000. She has said she would be fine with a payroll tax hike on all Americans, she has endorsed a steep soda tax , endorsed a national gun tax ,.

He would restore the individual mandate in the Affordable Care Act, which the Supreme Court has ruled was a de facto tax. Enacts the Buffett Rule, a minimum tax on Adjusted Gross Income over $1. I will not add taxes on anyone earning under $25000.

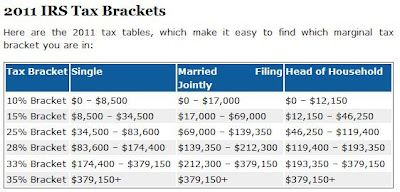

New Income Tax Tables.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.