What is the meaning of taxation in economics? The term taxation applies to all types of involuntary levies, from income to capital gains to estate taxes. Definition of taxation: A means by which governments finance their expenditure by imposing charges on citizens and corporate entities. Governments use taxation to encourage or discourage certain economic decisions. Taxation, imposition of compulsory levies on individuals or entities by governments.

Taxes are levied in almost every country of the worl primarily to raise revenue for government expenditures, although they serve other purposes as well. The most important source of government revenue is tax. A tax is a compulsory payment made by individuals and companies to the government on the basis of certain well-established rules or criteria such as income earne property owne capital gains made or expenditure incurred (money spent).

Consumers are free to decide how to spend or invest their time and money. The goal of producers is to make profits by satisfying consumer demand. Open competition among producers usually in their providing the best quality of goods or services at the lowest possible prices. Indirect taxes are taxes on expenditure (e.g. VAT).

They are paid to the tax authorities, not by the consumer, but indirectly by the suppliers of the goods or services Direct taxes are taxes on income, profits and wealth, paid directly by the bearer to the tax authorities. The main purpose of taxation is to accumulate funds for the functioning of the government machineries. In economics, taxes fall on whomever pays the burden of the tax, whether this is the entity being taxe like a business,.

A tax is a compulsory financial charge or some other type of levy imposed upon a taxpayer by a governmental organization in order to fund various public expenditures. A failure to pay, along with evasion of or resistance to taxation, is punishable by law. Taxation is the amount of money that people have to pay in taxes. Taxes consist of direct or indirect taxes and may be paid in money or as its labour equivalent. Most countries have a tax system in place to pay for public, common.

In recent years, taxation has been one of the most prominent and controversial topics in economic policy. The Tax Foundation is the nation’s leading independent tax policy nonprofit. Tax is an enforced fee that is charged on individuals and organizations by government or its agency on a product, income, or service. Despite many people complaining of making tax contributions to government, these contributions are very important for the economy of a country. Direct taxation is a type of tax which is paid for by an individual directly to the government.

It includes poll tax, land tax or income tax. These include: (1) Adequacy: taxes should be just-enough to generate revenue. Economic double taxation refers to the taxation of two different taxpayers with respect to the same income (or capital). A fee charged (levied) by a government on a product, income, or activity. If tax is levied on the price of a good or service, then it is called an indirect tax.

The purpose of taxation is to finance government expenditure. A progressive tax imposes a higher rate on the wealthy than on the poor. Poor families spend a larger share of their incomes on cost of living expenses.

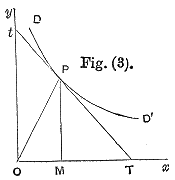

They need all the money they earn to purchase and pay for basics like shelter, foo and transportation. Tax incidence refers to how the burden of a tax is distributed between firms and consumers (or between employer and employee). The tax incidence depends upon the relative elasticity of demand and supply.

The consumer burden of a tax increase reflects the amount by which the market price rises.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.