The department also distributes revenue to local governments, libraries and school districts. With income tax fraud and identity theft on the rise, the. FreeTaxUSA is living proof. File State Tax es Fast, Easy, And Free! Maximum Refund Guaranteed.

Join The Millions Today! Pursuant to section 755. Revised Code , a board of county commissioners may pledge and contribute revenue from a tax levied for the purpose of division (A)(5) of this section to the payment of debt charges on bonds issued under section 755. The rate of tax shall be a multiple of one-twentieth of one per cent.

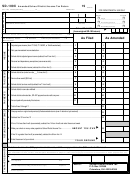

Chapter 718: MUNICIPAL INCOME TAXES. Any term used in this chapter that is not otherwise defined in this chapter has the same meaning as when used in a comparable context in laws of the United States relating to federal income taxation or in Title LVII of the Revised Code , unless a different meaning is clearly required. Tax returns and payments can be dropped off in the utility drop box in parking lot. Filing Tax es in Ohio.

The return must include the aggregate amount of the state or local income tax refund (credit or offset). Annual Interest Rate. Below is a list of the identification numbers of all public school districts in Ohio.

This rate does not apply to tax balances for any prior tax years, regardless of when they are file which are still subject to the interest rate of per month as stated in 890. Xenia residents who pay JEDD-tax may take full credit for this tax on their Xenia income tax return. The Columbus Income Tax Division provides the service of collection, audit, and enforcement of the 2. City of Columbus , as well as the excise lodging tax for the City of Columbus and the Franklin County Convention and Facilities Authority. Find the government information and services you need to live, work, travel, and do business in the state. Access IRS Tax Forms.

Complete, Edit or Print Tax Forms Instantly. Residency and Domicile. Municipal Income Tax Forms. Demographics and Data. Tax Rate The City of Sharonville has an earnings tax of 1. This tax must be paid to the City of Sharonville regardless of age or level of income.

The Income Tax Division provides administration of the City's Income Tax Ordinance and Rules and Regulations. Online eFile Tax Return Rejection Codes. If your online efile tax return was rejecte don't worry, since a rejection of an efile completed online tax return usually requires only a small correction.

Once you have completed the. Credit is given for other local taxes paid to another municipality up to 2. Ohio Sales and Use Tax Rates. Refund requests must be made within three years from the date of your tax payment, the date the tax return was due, or within three months after final determination of your federal income tax liability, whichever is later.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.