Free for Simple Tax Returns. Maximum Refund Guaranteed. Industry-Specific Deductions. Get Every Dollar You Deserve. Connect With A Live Tax CPA. Available Nights And Weekends.

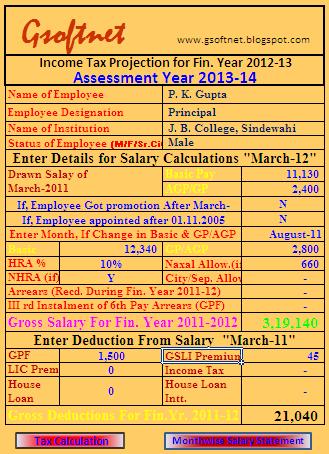

Individual taxpayers enjoy a basic exemption limit, wherein income upto such limit is not taxed. The basic exemption limit varies from taxpayer to taxpayer basis the age of the taxpayer. While trading for shares in the stock market, there may be intraday gain(Buying and selling shares on same day) or short term gain (sold with in one year of buying) and long term gain when someone sells shares after one year of holding. Use this easy to use salary tax calculator to estimate your taxes. Here are the newly proposed income tax slabs: No income tax for those earning less than Rs lakh.

Rs lakh will be taxed at per cent. For Salaried – You can use the calculator given above and decide every year. Income between Rs lakh and Rs 7.

For Business Owners and Professionals – You should consult an professional tax consultant as you only have option to choose between slabs once. Government’s main purpose of introduction of these New Slabs is to simplify the income tax process and procedures. Earlier PAN was mandatory).

Interest deduction on housing loan under Section 80EEA increased by 1. This post is useful to calculate income tax every year, but you have to change income tax slab as per given income tax department. Give your important suggestion regarding this post in comment box. By introduction of this, Government is expecting a loss of Rs.

In order to understand how income tax slab works, first it is important to understand the different elements based on which tax slabs are made. For salaried taxpayers, standard deduction has been raised from the current ₹40to. Just enter your anual income and let the tax calculator calculate the tax for you.

Tax calculators make use of information related to your income , deductions and HRA exemption to provide approximate figures of income tax to be paid. No Matter How Complicated Your U. Follow these steps to find out whether you will save money with the new tax slabs or whether you should stick with the old tax slabs. In the same way, there is a tax rate on income above lakhs and up to ₹. List of Tax Deductions and Exemption The main difference between old and new tax slabs is the exemptions and deductions you are claiming. The calculation of income tax that you are liable to pay under the new tax regime can be explained with an example.

Further, during the year, your employer has contributed Rs 60to your NPS account, which is eligible for deduction under section 80CCD (2).

The income tax on your salary will be calculated depending on the tax slab. The taxable income will be worked out after making applicable deductions, if any. If you invest in life insurance, you can claim deduction from taxable income of life insurance premium paid upto Rs.

Learn How is income tax calculated and check latest tax slabs , deductions, exemptions.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.