Industry-Specific Deductions. Get Every Dollar You Deserve. Free for Simple Tax Returns. Maximum Refund Guaranteed. Increase Your Tax Savings. Tax Tips for the Self-Employed. Find Out More About Your Taxes! How do you file taxes for a business?

What is business tax forms do I need for taxes? What tax forms do I use to file my business return? How to find tax preparer for your business taxes?

The federal income tax is a pay-as-you-go tax. You must pay the tax as you earn or receive income during the year. See all full list on irs. When it’s time to file a federal income tax return for your small business , there are various ways you can do it, depending on whether you run the business as a sole proprietorship or use a legal entity such as an LLC or corporation. Each type of entity requires a different tax form on which you report your business income and expenses.

The most common forms of business are the sole proprietorship, partnership, corporation, and S corporation. A Limited Liability Company (LLC) is a business structure allowed by state statute. Legal and tax considerations enter into selecting a business structure.

If you decide to close your business, you must file a final business tax return with the Department of Revenue within days of closing and pay any tax that is due (minimum of $22). Businesses holding minimum activity licenses that do not file tax returns should notify local city and county officials or the Department of Revenue that the business is closed. The deadline for your tax return is months after the end of the accounting period it covers.

You’ll have to pay a penalty if you miss the deadline. It’s usually months and one day after the end of the accounting period. Access IRS Tax Forms. Complete, Edit or Print Tax Forms Instantly.

Choose an Accounting Basis. One decision the owner must make is whether to prepare. The next decision to consider is which depreciation method to use. These services are provided only by credentialed CPAs, Enrolled Agents (EAs), or tax attorneys.

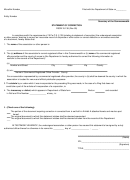

Business Tax Forms Online Filing - All business tax return s must be filed and paid electronically. Please visit the File and Pay section of our website for more information on this process. Paper returns will not be accepted unless filing electronically creates a hardship upon the taxpayer. There might be instances in the future where the need to provide information from these returns will arise, such as applying for a working capital loan, buying a new building, or even as simple as switching CPAs or attorneys. Approval and loan amount based on expected refund amount, ID verification, eligibility criteria, and underwriting.

If approve funds will be loaded on a prepaid card and the loan amount will be deducted from your tax refun reducing the amount paid directly to you. Tax returns may be e-filed without applying for this loan. Your business tax return is due on the 15th day of the fourth month following the end of your fiscal year.

For example, if your fiscal year coincides with the calendar year, then your return will be due on April 15. The business tax rates vary, depending on your classification and whether you are a retailer or a wholesaler. Prior Year CBT Tax Forms. The Division is in the process drafting information regarding these changes. Corporation Business Tax Reform.

If you have any outstanding tax returns, the due date is October. This is the standard quarterly return for reporting the Modified Business Tax for General Businesses. Our mission is to promote voluntary compliance with all tax laws through information, education, assistance and customer service.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.