The Legislature is also responsible for assessing what taxes should be paid by individuals and businesses. Government Departments and Agencies Find contact information for U. Get contact information for each state and territory. Taxes and the Government.

A precursor to the IRS was originally.

In the OEC only Chile and Mexico are taxed less as a share of their GDP. If you are eligible for a federal tax refund and don’t file a return, then your refund will go unclaimed. The percentage breakout is income taxes at and payroll taxes at , for a total of. Access IRS Tax Forms.

Complete, Edit or Print Tax Forms Instantly. In the US, what is the government agency that collects taxes ? Internal Revenue Service (IRS) C. Federal Tax Collectors (FTC) B.

All the states have their individual tax departments. The federal government of the U. Additionally, most states and some local government have their own income taxes. Skip to main content.

Which agency collects taxes from workers to pay benefits. Department of the Treasury responsible for collecting federal taxes of. This percentage is called an income tax rate. This means that as a person earns.

What is the agency that collects taxes in the U. State Laws and Regulations. Find state laws and regulations with the Law Library of Congress’s guide for each state. But if you’re a 3rd party seller on Amazon , where you collect sales tax and where Amazon.

Sales tax is governed at the state level and no national general sales tax exists. Forty-five states , the District of Columbia, the territories of the Puerto Rico, and Guam impose general sales taxes that apply to the sale or lease. Typically, early sales tax laws allowed only the taxation of “tangible personal property” (TPP), rather than taxing services.

Most states charge sales tax on most products sold in the state, but sales taxes on services vary widely. The income tax system is designed to be progressive.

That is, the wealthy are meant to pay a larger percentage of their earnings than middle- or low-income earners. Income taxes can be levied both on individuals (personal income tax) and businesses (business and corporate income taxes ). The Constitution gave Congress the power to levy federal taxes. Debt Collection Improvement Act. By law, businesses and individuals must file an income tax.

Each has its own authority to tax. For example, states can set their own sales and payroll taxes that apply only within the state. Similarly, local governments can impose a variety of taxes , such as property taxes. As shown in figure below, taxes on individual and corporate income account for almost half of total U. The IRS has offices throughout Texas where you can meet with an agency representative. If you would like to visit an office, call the nearest IRS office to schedule an appointment.

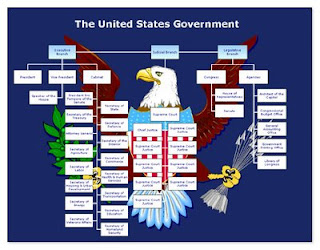

The challenges we all are facing are new and unexpected. We acknowledge that state governments must continue to collect the taxes owed to them, but we hope that tax authorities will recognize that many tax administration requirements are ancillary or even counterproductive to that end in our new environment. How much tax money does the federal government take in ? Total federal revenues were $2. Ross Marchand of the Taxpayers Protection Alliance breaks down a brief history of income taxes in the. These levels descend from the department head in a mostly hierarchical pattern and consist of essential staff, smaller offices, and bureaus.

Tobacco products are taxed in two ways: the unit tax , which is based on a constant nominal rate per unit (that is, per pack of cigarettes), and the ad valorem tax , which is based on a constant fraction of either wholesale or retail price. Gas is taxed at cents a gallon—one of the lowest rates in the.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.