It’s a good idea to review the new changes, especially if you usually itemize deductions. Wages and self-employment income are subject to Social Security and Medicare taxes. Together, Social Security and Medicare taxes are known as FICA (Federal Insurance Contributions Act) taxes and are taken right out of your paycheck.

Tax will increase, since the bracket will be gone Do you have kids? If you qualify for the earned income credit, you will get an increase in your refund.

This is if they are repealed for everyone. An increased tax credit for families with or more children. Additional marriage penalty relief for married couples filing joint returns. See all full list on fool. Congress recently passed the Tax Cuts and Jobs Act, which is the most dramatic change to the U. GOP leaders in Congress claimed that the bill would cut taxes for middle-income Americans and working families , as well as spur economic growth.

It will make the distribution of after-tax income more unequal.

It cuts individual income tax rates , doubles the standard deduction , and eliminates personal exemptions. Access IRS Tax Forms. Complete, Edit or Print Tax Forms Instantly. Free for Simple Tax Returns. Maximum Refund Guaranteed.

Get a Jumpstart On Your Taxes! Industry-Specific Deductions. Get Every Dollar You Deserve. File Taxes From Your Home. GOP tax bill: How the new tax plan will affect you.

Ways the New Tax Law Affects Millennials. All of them go into effect with. There is also an overview of some, much-discussed. Try our calculator to find out.

There are tax cuts for low and middle income earners, and benefits for small business owners.

Overall, the changes associated with the new tax law may lower taxes for individuals and small businesses. Under the plan, tax brackets would be reduced from seven to four, and the standard deduction would be increased. The inflation-adjusted. Some of the most important changes center on key deductions and credits that could have a significant impact on the younger generation of taxpayers. And while the bulk of.

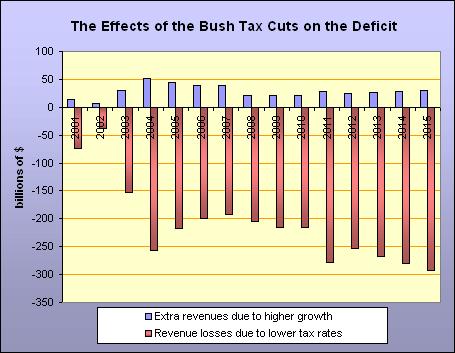

Being an election-year Budget, Mr Frydenberg’s first is full of goodies. Our Budget calculator will tell you exactly how you’ll benefit from, in Mr Frydenberg’s words, a Budget for “a stronger economy that benefits you”. These tax cuts are deficit finance and they occur in a context of rising government debt burdens.

Eventually, these tax cuts must be paid for with either future tax increases or spending cuts (or some combination thereof). Senate Republicans voted to pass their version of tax legislation on December 2. This major tax legislation will affect individuals,. President Trump to give tax cuts to the rich,” she said.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.