Free IRS Tax Filing Made Easy With Step-By-Step Instructions To Help You File Fast. How to order IRS forms? Tax code declaration IR330. What is IRS Form 720? Schedular payment earners.

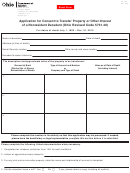

Do not use this form if you’re a contractor receiving schedular payments, use the Tax rate notification for contractors IR330C instead. Use a separate form for each employer and use only one tax code on this form. Follow the screens through the process. Select the date you want your payment to be received. Once accepte you’ll get an EFT Acknowledgment Number as your receipt.

The official mobile app of the IRS Learn more Social Security beneficiaries who are not typically required to file tax returns will not need to file to receive an economic impact payment. If you’re a contractor or use a WT tax code , you’ll need to use the Tax rate notification for contractors (IR330C) form. Once completed: Employee Give this form to your employer. See all full list on hrblock. It shall be the duty of the Commissioner or his duly authorized representative or an authorized agent bank to whom any payment of any tax is made under the provisions of this Code to acknowledge the payment of such tax , expressing the amount paid and the particular account for which such payment was made in a form and manner prescribed.

Find forms and instructions. However, you can search our forms by number or tax type if you want to view instructions or access a form. Your tax code will normally start with a number and end with a letter.

L is the tax code currently used for most people who have one job or pension. Instant Downloa Mail Paper Copy or Hard Copy Delivery, Start and Order Now! Prevent new tax liens from being imposed on you. Invalid or missing account numbers cause of all the tax notices we receive.

Please send CBIZ the account number to prevent potential penalties and interest. The forms listed below are PDF files. They include graphics, fillable form fields, scripts and functionality that work best with the free Adobe Reader. While other browsers and viewers may open these files, they may not function as intended unless you download and install the latest version of Adobe Reader. Stay informed about coronavirus (COVID-19): Governor Lamont is telling Connecticut residents to Stay Safe, Stay Home.

All nonessential workers are directed to work from home, and social and recreational gatherings of more than five are prohibited. Employers with worksites located in Pennsylvania are required to withhold and remit the local Earned Income Tax (EIT) and Local Services Tax (LST) on behalf of their employees working in PA. Examples of business worksites include, but are not limited to: factories, warehouses, branches, offices and residences of home-based employees. It’s used for most people with one job and no untaxed income, unpaid tax or taxable benefits (for example a company car).

L is an emergency tax code only if followed by ‘W1’, ‘M1’ or ‘X’. Emergency codes can be used if a new employee doesn’t have a P45. Access IRS Tax Forms.

Complete, Edit or Print Tax Forms Instantly.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.