A stylesheet is provided for the XHTML. PCC files are text files containing GPO photocomposition codes (i.e., locators). Other articles from loc.

This convenient, easy-to-use volume provides you with the complete legislative history and a comprehensive topic index to speed your tax research. This site is updated continuously and includes Editor’s Notes written by expert staff at Bloomberg Tax indicating when a section has been repealed or when there is a delayed effective date allowing you to see the current and future law. The official mobile app of the IRS Learn more Social Security beneficiaries who are not typically required to file tax returns will not need to file to receive an economic impact payment. Free Federal Tax Filing Online. Enter a term in the Find Box.

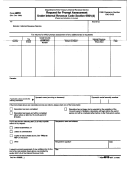

Select a category (column heading) in the drop down. Click on column heading to sort the list. You may be able to enter information on forms before saving or printing.

To revise the internal revenue laws of the United States. Amounts attributable to employer contributions. The term includes corresponding provisions of subsequent federal tax laws.

Required distributions— (A) In general. A trust shall not constitute a qualified trust under this subsection unless the plan provides that the entire interest of each employee— (i) will be distributed to such employee not later than the required beginning date, or. Definitions and special rules.

Tax tables for individuals. Cross references relating to tax on individuals. THE BUREAU OF INTERNAL REVENUE SECTION 1. Official Publications from the U. Section 48A tax credits for integrated gasification combined cycle (IGCC) projects. Code and to other laws entirely.

The regulations affect persons who exchange personal property or multiple properties. Internal Revenue Code. Use this page to navigate to all sections within Title 26. Expand sections by using the arrow icons.

An organization described in subsection (c) or (d) or section 4(a) shall be exempt from taxation under this subtitle unless such exemption is denied under section 5or 503. TITLE II—AMENDMENTS TO THE INTERNAL REVENUE CODE RELATING TO RETIREMENT PLANS Sec. Subtitle A—Participation, Vesting, Funding, Administration, Etc. PART 1—PARTICIPATION, VESTING, AND FUNDING Sec.

Minimum participation standards. Suspension of Rulings. Legislative Recommendations Most Serious Problems Most Litigated Issues Case Advocacy Appendices.

As a point of comparison, total individual income tax revenue was projected to be about $1. A affects nonqualified retirement plans and other deferred compensation arrangements.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.