State and local taxes and rules vary by jurisdiction, though many are based on federal concepts and definitions. Corporate Tax - investopedia. What states have no corporate taxes?

Who really pays the corporate income tax? CIT rates vary from state to state and generally range from to (although some states impose no income tax). The most common taxable base is federal taxable income, which is modified by state provisions and generally is apportioned to a state on the basis of an apportionment formula consisting of one or more of the following: tangible assets and rental expense, sales and other receipts, and payroll. As such, the statutory corporate income tax rate in the United States, including an average of state corporate income taxes, is 25. This rate puts the United States in line with the average among Organisation for Economic Co-operation and Development (OECD) member nations.

For example, the United States has the highest corporate income tax rate set at percent at the federal level, but the average tax on corporate income at the state and local levels amounts to an additional percent, which brings the total tax rate to percent. The marginal corporate tax rate in the United States is at the federal level and 39. In addition to the federal corporate income tax, which applies to all corporations nationwide, all but six states charge an additional state corporate income tax on top. KPMG’s corporate tax table provides a view of corporate tax rates around the world.

Use our interactive Tax rates tool to compare tax rates by country, jurisdiction or region. Provincial general corporate income tax rates range from 11. Branch profits tax of also levied. Cayman Islands No income tax. Chad Rate is for public institutions, communities and nonprofit organizations.

Rate is to for companies operating in hydrocarbons sector. As companies looked elsewhere, the United States lost out on new jobs and new investments. America’s competitiveness on the.

This rate will be effective for corporations whose tax year begins after Jan. CBO estimates that the U. Taxes are based on operating earnings after expenses have been deducted. The corporate tax rate in the United States is currently at a flat rate of. In the United States, taxes on income and profits of individuals alone generated percent of total tax revenue, compared with percent on average within the OECD.

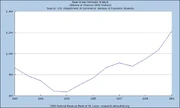

Social Security Contributions: The United States collected slightly less revenue from retirement, disability, and other social security programs—percent of total tax revenue—than the percent OECD average. Access IRS Tax Forms. Complete, Edit or Print Tax Forms Instantly. It is common to say that the U. You need a Premium Account for unlimited access. Since then the rate has increased to as high as 52.

However, due to tax breaks and. On net, those changes led to a reduction in the estimates of effective corporate tax rates from 18. The plan aims to bring revenue back into the country from U. The United States has income tax treaties (or conventions) with a number of foreign countries under which residents (but not always citizens) of those countries are taxed at a reduced rate or are exempt from U. Property Tax Rates by State. Every state and county in the United States collects a property tax on real estate, buildings, and other forms of property owned within their jurisdiction. Taxes collected on an identical property may vary widely depending on where the property is locate even within in the same state.

Filing Tax es in Colorado.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.