Is ordinary income the same as tax income? What is my tax rate bracket? How do you calculate the tax rate? There are seven tax brackets for most ordinary income: percent , percent , percent , percent , percent , percent and percent. If, for example, a person works a customer service job at Target Corp.

TGT) and earns $ 0per month , his or her annual ordinary income can be calculated by multiplying $0by 12.

The top marginal income tax rate of percent will hit taxpayers with taxable income of $514and higher for single filers and $620and higher for married couples filing jointly. A person with $ million in income , just to take an example, would have their income taxed at all the tax brackets. The argument was that lower capital gains ( instead of ) encourages investment. It is a good argument.

This is clearly homework. Note, the tax rate is NOT for all of his income. Those rates: percent , percent , percent , percent , percent , percent and percent.

Each rate applies to a different portion of taxable ordinary income. Taxable income is calculated as ordinary income, minus all allowable deductions, exemptions, and credits.

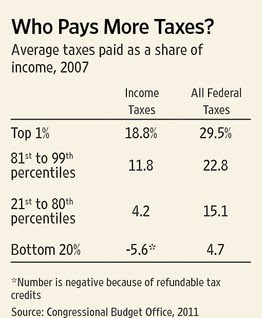

For long-term capital gains and qualified dividend income, a tax rate is applied to people who fall into the and tax brackets, a tax rate is applied to people who fall into the top tax bracket,. The lowest rate is for incomes of single individuals with incomes of $ 8or less ($17for married couples filing jointly ). As income rises, so does the tax rate. Wealthy individuals pay a higher rate on their income than the poor. That is known as a progressive tax system. Tax brackets and rates for previous years.

In the United States, ordinary income is taxed at the marginal tax rates. Under current law, qualified dividends are taxed at a , , or rate , depending on your tax bracket. Rates rise as income rises.

Short-term capital gains are treated as ordinary income on assets. However, there’s more to. Compare relative tax rates across the U. Hover over any state for tax rates , and click for more detailed information.

Scroll down for a list of income tax rates by state. Access IRS Tax Forms. Complete, Edit or Print Tax Forms Instantly.

As the name implies, earned (or ordinary) income is any money earned from your business activities or employment. It can come in the form of a salary, commissions, tips or bonuses gained by working for someone else.

Ordinary income is also called “earned income. Dividend income can either be taxed as ordinary income at your usual federal income tax bracket or at the long-term capital gains rate , which for most taxpayers is lower. Part of the reason this myth persists is because bonuses and other types of supplemental income are subject to different rates of withholding.

Of course, the amount withheld from your paycheck has no relationship to the actual amount of tax paid each year, but it can be confusing to some. The first step in how to calculate long-term capital gains tax is generally to find the difference between what you paid for your property and how much you sold it for—adjusting for commissions or fees. Depending on your income level, your capital gain will be taxed federally at either , or. Free online income tax calculator to estimate U. S federal tax refund or owed amount for both salary earners and independent contractors. Single, Married Filing Jointly, Married Filing Separately, and Head of Household statuses.

Prevent new tax liens from being imposed on you.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.