Let Us Deal with the IRS. FreeFile is the fast, safe, and free way to prepare and e- le your taxes. It s fast, simple, and secure. First, they find the $2300–23taxable income line. Next, they find the column for married filing jointly and read down the column.

The amount shown where the taxable income line and filing status column meet is $651. Income Tax Brackets and Rates. Other articles from taxschedule. How to compute your total taxable income?

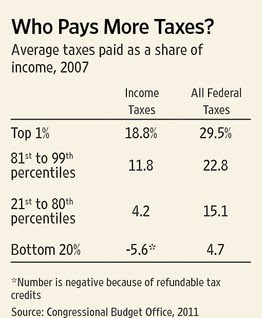

Remember to start with your taxable income , which is your adjusted gross income minus your standard deduction or itemized deductions. What is my tax rate bracket? On a yearly basis the IRS adjusts more than tax provisions for inflation. This is done to prevent what is called “bracket creep,” when people are pushed into higher income tax brackets or have reduced value from credits and deductions due to inflation, instead of any increase in real income.

You can find them at irs. If you were looking at a table online, scroll up a little. Brown are filing a joint return. View: Publications Publications. Links Inside Publications.

Questions Answered Every Seconds. Maximum Refund Guaranteed. Free for Simple Tax Returns. Tables use taxable income. Tax tables are based on taxable income , not your gross income.

The IRS allows you to take certain deductions from your gross income to calculate your taxable income.