Avoid surprise fees, reduce rejected shipments, and increase customer satisfaction. See if You Qualify for No-Cost. Tax Compliance Process. Find The Right One For You.

Avalara Can Simplify Sales Tax. We Connect With Over 5Systems. Take The Guessing Out Of Taxes.

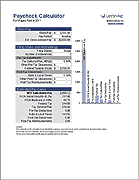

To calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year. This number is the gross pay per pay period. Subtract any deductions and payroll taxes from the gross pay to get net pay. The PaycheckCity salary calculator will do the calculating for you. Our income tax calculator calculates your federal, state and local taxes based on several key inputs: your household income, location, filing status and number of personal exemptions.

This is only a ready reckoner that makes standard assumptions to estimate your tax breakdown. How do you calculate taxes out of your paycheck? What percentage of a paycheck goes to taxes? How to calculate federal taxes on your pay? What is the best free tax calculator?

The Law requires an employer to pay -in the PAYE. As a result, your employer may be using a different federal Basic Personal Amount to calculate your pay. If this is the case, you may see a difference between your pay and the Payroll Deductions Online Calculator. Maximum Refund Guaranteed. The calculator above can help you with steps three and four, but it’s also a good idea to either double-check the calculator by using the payroll tax rates below, or save time and effort by using a reliable payroll service.

The steps our calculator uses to figure out each employee’s paycheck are pretty simple, but. Salary Income Paycheck Calculator If your employee earns a set salary, the salary paycheck calculator is the perfect option. Use it to estimate net vs. Wor salaried employees after federal and state taxes. If an employee has requested a voluntary deduction for tax withholding, no problem—you can include that info too.

Hourly rates, weekly pay and bonuses are also catered for. Why not find your dream salary, too? For more information see assumptions and further information. We calculate how much your payroll will be after tax deductions in any region. Personal income taxes in Belgium can be complicated and difficult to calculate yourself.

The calculations provided should not be considered financial, legal or tax advice. This calculator provides an estimate of the Self-Employment tax (Social Security and Medicare), and does not include income tax on the profits that your business made and any other income. For a more robust calculation, please use QuickBooks Self-Employed. This includes first and second quarter estimated tax payments normally due April and June 15. IRS is offering coronavirus relief to taxpayers.

Taxes must be paid as you earn or receive income during the year, either. Usage of the Payroll Calculator. Select the province: the calculator is updated with the tax rates of all Canadian provinces and territories. Enter your pay rate: the amount can be hourly, daily, weekly, monthly or even annual earnings.

More information about the calculations performed is available on the about page.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.