According to the Tax Foundation ’s Taxes and Growth Model, Hillary Clinton ’s tax plan would reduce the economy’s size by percent in the long run. The plan would lead to 0. Sean Williams has no material interest in any companies mentioned in this article. She’ll close loopholes that create a private tax system for the most fortunate, and she’ll ensure multi-million-dollar estates are paying their fair share of taxes.

Close corporate and Wall Street tax loopholes and invest in America.

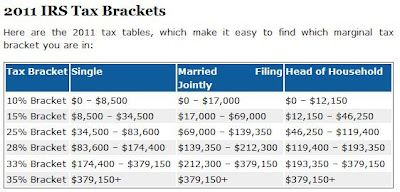

Hillary will close tax loopholes like inversions that reward companies for shifting profits and jobs overseas. On top of the new capital gains tax rates , Clinton would preserve the current 3. This act created a percent to 39. Businesses were given an income tax rate of. Instead of a single long-term gains rate that kicks in after one year, her plan would create a series of rates ranging from to for those who hold investments for at least two years but. With Warren Buffett’s blessing, Hillary Clinton said Wednesday she would go beyond what President Barack Obama has proposed and push for a tax system that ensures the wealthiest Americans pay.

But the single, childless person with $120or $420in income—the top or 0. Trump’s plan than under Clinton’s or under current law.

I call on the people of New York to let Congress know that what they are doing is just wrong. I want to make it clear that New York will not stand for this kind of irresponsible behavior out of Washington. Enacts the Buffett Rule, a minimum tax on Adjusted Gross Income over $1. In addition, it removed the cap on the 2. Medicare payroll tax , raised the corporate tax rate to from ,. So in this scenario, the tax savings would be capped at $8for $10in mortgage interest.

Naturally, this provision only affects people who are in a tax bracket higher than. Increase tax rate tiers on capital gains. Hillary Clinton proposes raising taxes on high-income taxpayers, modifying taxation of multinational corporations, repealing fossil fuel tax incentives, and increasing estate and gift taxes. Her proposals would increase revenue by $1.

As a couple, Hillary and her husban former President Bill Clinton, deducted $2. Bill and Hillary Clinton ’s Tax Returns Revealed Controversial Connection. Democratic presidential candidacy.

Hillary Clinton on Friday proposed a significant hike on capital gains taxes for some investors, a plan favored both by progressive economists and some Wall Street investors. In contrast, Hillary Clinton wants to raise this tax. Donald Trump, like most Republicans, wants to repeal the estate tax.

Currently estates smaller than $5.

Clinton first proposed a higher tax rate () and a lower threshold ($ million) for applying the tax. From the Tax Policy Center. WASHINGTON—Hillary Clinton will propose a revamp of capital-gains taxes that would hit some short-term investors with higher rates, part of a package of measures designed to prod companies to put more emphasis on long-term growth, a campaign official said. In proposing a plan to cut the deficit, Clinton submitted a budget and corresponding tax legislation that would cut the deficit by $5billion over five years by reducing $2billion of spending and raising taxes on the wealthiest 1.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.