Local corporation tax applies at 4. Business tax comprises of regular business tax , special local corporate tax and size-based business tax. The tax treaty was concluded mainly for the purpose of information exchange. However, the WHT rate cannot exceed 20.

It is for illustration purpose only.

KPMG’s corporate tax table provides a view of corporate tax rates around the world. For corporate tax , corporations are divided into two categories: domestic corporations and foreign corporations. Foreign corporations are those, which are not considered domestic, as well as branch.

Emphasis is placed on corporate tax structures, tax treaties, and personal taxes. April and further trim it in coming years in a bid to spur business investment and growth. Japanese business taxes.

A corporate tax is a tax imposed on the net profit of a corporation that are taxed at the entity level in a particular jurisdiction.

Such taxes may include income or other taxes. Special Reconstruction Tax. We strive to provide our clients with world-class tax compliance services. Corporation tax is levied on corporations’ income. We provide a full suite of corporate tax services to help our clients meet their compliance needs.

The tax credit for the promotion of income growth and the tax credit for job creation may be taken in the same fiscal year, if certain adjustments are made. If you have any question, please contact the nearest Tax Office. The contents reflect the information available up to. Lowering the corporate taxation rate was important aspect of the growth strategy of the present. After operating earnings is calculated by deducting expenses including the cost of goods sold ( COGS ) and.

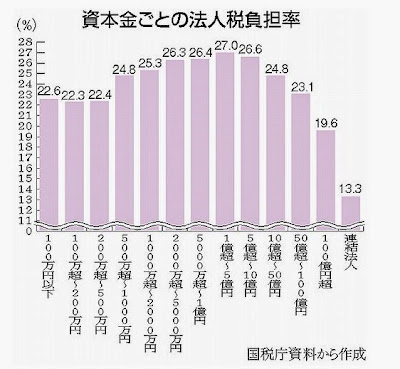

To get an idea of the effective corporate tax rates around the worl we can look at data compiled by the Organisation for Economic Co-operation and Development, or OECD. Tax rates vary based on the corporate laws of each nation. The rebate will not apply to income derived by a non-resident company that is subject to final withholding tax.

Companies could not deduct research and development spending or investments in a low-income neighborhood. Kabushiki-Kaisha (KK) A KK is taxed at two levels.

This website is not the reference, it has been made for you to quickly get an idea of the amount of taxes you might have to pay. Refer to your city office to know exactly how taxation works for you. Feel free to participate in the comments at the bottom of this page.

The agency said large companies. Tax breaks contingent on wage hikes, productivity-enhancing investment. The ten countries with the lowest corporate tax rates include: Anguilla. The programme aims to address the tax corporate governance of very large enterprises, numbering approximately 5nationwide, on the occasion of tax audits.

Tax on corporate profits is defined as taxes levied on the net profits (gross income minus allowable tax reliefs) of enterprises. It also covers taxes levied on the capital gains of enterprises. This indicator relates to government as a whole (all government levels) and is measured in percentage both of GDP and of total taxation.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.