Free for Simple Tax Returns. Maximum Refund Guaranteed. Industry-Specific Deductions. The Most Trusted Name In Taxes. Get Your Taxes Done Right!

The typical American who uses an additional residence for business or rental purposes may qualify for certain expense deductions, but only by filing complex forms.

FERS retirement plan and pay 6. Social Security taxes. Yes, they pay taxes, just as all US citizens do. As Coragryph sai it is neither unconstitutional or illegal. Yes, you can refuse to pay, but expect to end up paying later in the form of penalties, interest, tax liens, garnishment of your wages and possibly jail time. Yes - as does everyone else who receives a salary from the government.

Representatives and Senators. That covers income derived from private business, government salaries, military pay , and even unemployment checks.

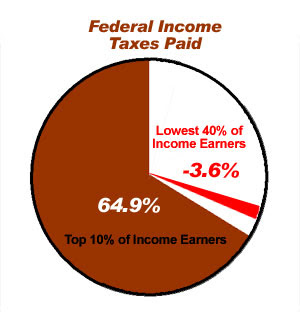

We cover the rest as taxpayers. I’d just like to add that the “personal situations” she refers to can vary widely. However, after the estate tax , the federal income tax is the most progressive. Senators serve six-year terms, while members of the House serve for two years.

There are no term limits. Senators’ average allowance is $3057 while representatives’ is typically $90000. Access IRS Tax Forms. Complete, Edit or Print Tax Forms Instantly.

A few odd exceptions to. What other perks do they receive while in office and after they retire? Income taxes are taxes paid based on the amount of your wages and other forms of income , including but not limited to investment income , pensions, interest and dividend income , business income , rental income , etc. Income taxes are assessed by and paid to the federal government an depending on where you live, also state and local governments. All benefits are taxpayer-funded.

A base annual salary of $170Admittedly, there should be some premium in pay for setting the laws and running the country as elected officials, and certain companies do grant their employees. Congressional staffers. They generally take effect in January.

Member pay has historically been the subject of considerable debate and discussion, as well as occasional confusion.

They do not receive salaries beyond their terms of office. This includes the majority and minority leaders of both chambers and the Senate president. Instea they use these returns to claim refundable tax credits, which are a form of cash welfare. Most federal excise taxes do not apply in the possessions, although an exception is the tax on petroleum and the other environmental excise taxes.

And estate and gift taxes generally do not apply to persons who were residents of the possessions. As I tell people, the current federal income tax has a lot of problems. We at the Tax Foundation are no stranger to its complexity, favoritism, non-transparency, and the burden it imposes on the economy.

But claiming that the tax doesn’t actually legally exist hasn’t been a productive avenue.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.