Find Out What Your Refund Will Be Before Filing. Take The Guessing Out Of Tax es. Free for Simple Tax Returns. Maximum Refund Guaranteed. Increase Your Tax Savings. Industry-Specific Deductions. Get Every Dollar You Deserve.

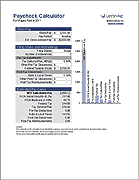

Salary Income Paycheck Calculator If your employee earns a set salary, the salary paycheck calculator is the perfect option. Use it to estimate net vs. Wor salaried employees after federal and state taxes.

If an employee has requested a voluntary deduction for tax withholding, no problem—you can include that info too. Payroll Tax Calculator. With our payroll tax calculator , you can quickly calculate payroll deductions and withholdings – and that’s just the start! It only takes a few seconds to calculate the right amount to deduct from each employee ’s paycheck, thus saving you time and providing peace of mind. Our household employment calculators help you estimate taxes – and tax savings – so you can easily run scenarios and make good money management decisions.

If you have questions about your specific situation, just give us a call. How do you calculate employer taxes? How much do employers pay for payroll taxes? What taxes do employers pay for employees?

How to calculate payroll taxes calculator? This includes taxpayers who owe alternative minimum tax or certain other taxes , and people with long-term capital gains or qualified dividends. Tax information for employees , including deductions, income and withholdings and employee investments. Do your Tax Return with Confidence: Quickly, Easily and Correctly with TaxTim. Get a Jumpstart On Your Taxes!

File Taxes From Your Home. You each also pay Medicare taxes of 1. If you are self-employe your Social Security tax rate is 12. The tax rate is of the first $0of taxable income an employee earns annually.

If your company is required to pay into a state unemployment fun you may be eligible for a tax credit. Deduct federal income taxes, which can range from to. Self-employment tax consists of Social Security and Medicare taxes for individuals who work for themselves. Withholding information can be found through the IRS Publication 15-T. Our income tax calculator calculates your federal, state and local taxes based on several key inputs: your household income, location, filing status and number of personal exemptions.

The employee gives you information on tax status and possible deductions and other factors and you use to find the withholding amount. An employee can change the information on their W-at any time, and as often as they wish, but only once per pay period. Employees cost a lot more than their salary.

About Tax Calculator. This tax calculator can provide accurate tax calculations for three different types of employment structure: employed , self employed or construction industry. There are a few key differences in the calculations between self employed and employed. Access IRS Tax Forms.

Complete, Edit or Print Tax Forms Instantly.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.