Free for Simple Tax Returns. Maximum Refund Guaranteed. Find Out More About Your Taxes! Increase Your Tax Savings. The deadline is January 31st of the following year.

Self -Employment tax breakdown. You pay £0() on your self -employment income between £and £1000. You pay £2() on your self -employment income between £10and £2000. More information about the calculations performed is available on the details page.

You each also pay Medicare taxes of 1. Do I need to complete a self - assessment tax return? What is tax self assessment? How do you calculate taxable income?

How to pay self assessment? The key difference is in two areas, National Insurance Contributions and the ability to deduct expenses and costs before calculating any deductions. Enter your estimated weekly or monthly profit to get an idea of how much Income Tax. The Capital Gains Tax shares and property calculators have been added to the list of tools. Estimate how much Income Tax and National Insurance you can expect to pay for the current tax year.

If you’re self -employe. Industry-Specific Deductions. Get Every Dollar You Deserve. There is no specification for the date of payment.

It can be paid online through a few simple steps. It can also be calculated with a simple procedure. Individuals are expected to compute the final liability of. A tax calculator can help you assess how much income tax you need to pay if you use self assessment. You can use a self assessment calculator to estimate future bills and when payment is due, so that you can arrange financing if needed.

However knowing your income is an important first step in dealing with any personal debts you might have. Self-employed income calculator.

The Crunch Personal Tax Estimator will help you to plan for the tax you may have to pay on your personal income including from sole trade income, salary, dividends and other sources. Please note that the Crunch Personal Tax Estimator will only provide an estimate of your tax liability. You are required to pay self -employed tax if you earned $4and above. Calculator Tax Calculators. Use the simple tax calculator or switch to the advanced tax calculator to review employers national insurance payments, income tax deductions and.

Whereas employees only pay the. As long as you also live there, you can actually claim the first £5as a flat tax relief. It’s called the Rent-a-Room Scheme, and it’s one of the best tax reliefs landlords can get.

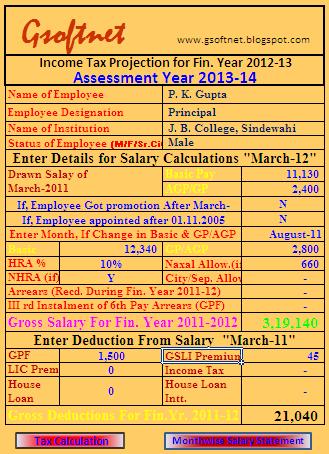

Tax Paid – total self employed tax paid under the construction industry scheme. Class National Insurance – Class National Insurance is deducted by HMRC if you earn over a certain amount and is in addition to any tax paid. Note: This template has been designed for income tax and monthly salary calculation purposes and does not represent a full payroll solution. In case you forget to pay your income tax on time due to some reason, you should be aware of the method of calculating the interest penalty under sections 234A, 234B, and 234C that you will have to pay in order to avoid any future confusion. All taxes should be paid before the end of a financial.

The Income Tax Department NEVER asks for your PIN numbers, passwords or similar access information for credit cards, banks or other financial accounts through e-mail.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.