Tax Tips for the Self-Employed. Find Out More About Your Taxes! Free for Simple Tax Returns. Maximum Refund Guaranteed. Increase Your Tax Savings. Industry-Specific Deductions. Get Every Dollar You Deserve. When is the deadline for corporate tax returns?

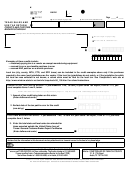

When and how to file corporate income tax? When are corporations required to file a tax return? This mailbox is for feedback to improve the tax calendar. This form is due the last day of the first calendar month after the calendar year ends.

Certain small employers use it instead of Form 9to report social security and Medicare taxes and withheld income tax. Requesting a federal income tax return extension automatically extends this date as well until Oct. The extended deadline is Oct.

Prevent new tax liens from being imposed on you. Access IRS Tax Forms. Complete, Edit or Print Tax Forms Instantly. Tax filing season is here again. Tax credits Some tax credits reduce the amount of BIRT owed to the City.

S corporation returns are due on or before the 15th day of the third month following the expiration of the taxable period (March for calendar year taxpayers). This has not changed from prior years. The return’s due date is May 15th for calendar year filers, and the 15th day of the fifth month following the close of the taxable year for fiscal year filers.

Extension requests received after the return’s due date or on paper will not be honored. Montana grants all C corporations an automatic six-month extension to file a return. Due Dates and Extensions. Who has to file a corporation income tax return. Filing requirements for resident and non-resident corporations.

When to file your corporation income tax return. Treturn filing deadlines and how to avoid penalties. If the tax return due date falls on a weekend or holiday, the due date is moved to the first following work day. In the case of a complete liquidation, or dissolution, of a corporation, the return is due on the 15th day of the fourth month following the month in which the corporation is completely liquidated.

June 3 we grant you an automatic seven-month extension of time to file your corporate tax return. Penalty is percent of the total unpaid tax due for the first two months. After two months, of the unpaid tax amount is assessed each month. The maximum late penalty is equal to of the unpaid tax owed. Interest is calculated by multiplying the current interest rate.

Motor Fuel More Information. Where do I mail my tax forms? For calendar year taxpayers and taxpayers with a fiscal year other than June 3 the due date is the th day of the th month after the beginning of the taxable year.

Filing due dates Update: Certain filing deadlines have been extended Some filing deadlines have been extended as part of the New York State Tax Department’s response to the spread of novel coronavirus (COVID-19) and its effect on taxpayers.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.