JAWS Accessibility Notice. FREE payroll deductions calculator and other paycheck tax calculators to help consumers determine the change in take home pay with different deductions. Good thing we’re experts in all tax code changes.

We’ll help you complete the new W-form correctly. Also, check back soon for our W-calculator to understand your withholdings and how to adjust them. Tying allowance to doing chores.

Keep regular chores separate from allowance (keep giving the allowance even if your child fails to do chores). To understand how allowances worke it helps to first understand the concept of tax withholding. Whenever you get pai your employer removes, or withholds, a certain amount of money from your paycheck. Result: Your net Paycheck will decrease. OHA rates are compiled by country and are updated based on new cost data and currency fluctuations.

The following information applies to all OHA tables: If only an island or country is liste all territory within the boundaries of the island or country is include including all offshore islands in the same general vicinity. This allowance is in addition to all other allowances authorized in this Joint Travel Regulation (JTR) and may be paid in advance. How do you calculate allowance?

How much tax is withheld per allowance? Accurate Calculations Guaranteed. Bend allowance calculator tells you the amount of metal to add.

The most important consideration when bending metal on a brake is the minimum bend radius. Use our free Capital Allowance calculator to find out how much capital allowance tax relief you could be entitled to through our experienced tax relief service. This is the base withholding allowance you place on your W-4. Calculator provides the most comprehensive free online US salary calculator with detailed breakdown and analysis of your salary including breakdwon ito hourly, daily, weekly, monthly and annual pay and tax rates.

Simply enter your annual earning below and hit Submit to see a full Salary and Tax illustration for the United States. The Form WWithholding Calculator takes you through each step of completing the Form W4. The Form Wprovides your employer with the details on how much federal, and in some cases, state, and local tax should be withheld from your paycheck. Extra Clothing Allowance.

These are additional initial and replacement allowances that are paid in unusual circumstances, such as when assigned to special details or duties. This free protein calculator estimates the amount of protein a person needs each day to remain healthy. It is based on certain averages as well as recommendations from institutions such as the World Health Organization. Free for Simple Tax Returns.

Maximum Refund Guaranteed. Increase Your Tax Savings. Industry-Specific Deductions. Get Every Dollar You Deserve.

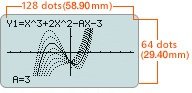

Bend Allowance Calculator The bend allowance and bend deduction are two measures that relate the bent length of a piece of sheet metal to the flat length. The bend allowance describes the length of the neutral axis between the bend lines, or in other words, the arc length of the bend. The powerful FederalPay Military Pay Calculator allows you to easily calculate yearly military compensation. Basic Pay and Subsistence Allowance (BAS) are calculated based on paygrade, and your Housing Allowance (BAH) is determined by zip code and dependants. Typically, members get SmartPoints on the Blue Plan, on the Green and on the Purple.

Regular Military Compensation (RMC) is defined as the sum of basic pay, average basic allowance for housing, basic allowance for subsistence, and the federal income tax advantage that accrues because the allowances are not subject to federal income tax. Pension schemes annual allowance checking tool. Use the annual allowance calculator.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.