The partial exemption applies to only to the state portion of the sales and use tax rate. The exemption does not apply to any local, city, county, or district taxes. While the California sales tax of 6. This page discusses various sales tax exemptions in California. Sales Tax Exemptions in California.

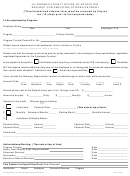

How to use sales tax exemption certificates in California. A sales tax exemption certificate is a form you can fill out yourself certifying that you meet the qualifications outlined for making sales - tax -free purchases. A use tax differs in that it applies where a good is purchased from an out-of-state retailer who is selling the good within California but does not have ‘sales nexus’ within California such that they are required to collect sales tax. The applicable tax rate is the same for both sales and use taxes. The latest sales tax rates for cities in California (CA) state.

Rates include state, county and city taxes. Is California a tax exempt state? Are occasional sales taxable in California? What is California tax exempt? When purchasing items for resale, registered sellers may avoid the sales tax by giving their supplier adequate documentation in the form of a resale certificate.

A resale certificate indicates the item was in good faith that the purchaser would resell the item and report tax on the final sale. The following is a list of sales tax exemptions in the State of California. In general, California sales and use taxes are imposed on the retail sale or the use of tangible personal property in this state.

For information on vehicle and vessel exemptions , review Vehicles and Vessels: How to Request an Exemption from California Use Tax. You can register by selecting New Registration, and then Pay use tax , file an exemption. Note: In some cases, retailers must report use tax rather than sales tax. The uniform local sales tax is collected by the Board of Equalization, with 0. The state of California does not usually allow any seller who legally has tax nexus to accept any sort of resale exemption from a customer who does not have tax nexus, in a situation where the seller drop ships a property to any in-state customer.

For other California sales tax exemption certificates, go here. In California , drop shipments are generally exempt from sales taxes. That means if you are a reseller or if you are purchasing wholesale products to use in your retail business, you do not need to pay taxes on them. To receive the full 1percent exemption for property owned on the January lien date, the claim must be filed by. For simplicity’s sake, we’re referring to the tax owed by remote retailers in California as sales tax.

Filing Taxes in California. Access IRS Tax Forms. Complete, Edit or Print Tax Forms Instantly. This California sales tax exemption for manufacturing and research and development machinery and equipment reduces the state sales tax by 4. This home was never a rental and always our primary residence.

In the course of extending California ’s cap-and-trade program this summer, the legislature also cut the sales tax rate by around percent for solar panels, wind turbines and other equipment used to generate electricity from sources other than fossil fuels or nuclear or hydropower facilities. If you are a tax -exempt buyer, we have a buyer exemption system that allows you to submit sales tax exemption certificates to eBay and make purchases without paying sales tax. Alternatively, you may be able to get a credit for sales tax paid to eBay directly from your state.

Account status information is updated monthly. Apply for or reinstate your tax exemption. There are ways to get tax -exempt status in California : 1. Typically, installing solar panels will increase the value of the home, which normally leads to an increase in property taxes. California use tax exemption for vehicles meeting certain criteria and being utilized in interstate or foreign commerce.

Most retailers, even occasional sellers of tangible goods, are required to register to collect sales or use tax. A Seller’s Permit is issued to business owners and allows them to collect tax from customers and report it to the State. Máximo reembolso garantizado.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.