You must withhold tax at the statutory rates shown below unless a reduced rate or exemption under a tax treaty applies. Section of the IRC imposes the corporate income tax. But those in the highest bracket don’t pay the highest rate on all their income. The official mobile app of the IRS Learn more Social Security beneficiaries who are not typically required to file tax returns will not need to file to receive an economic impact payment. The maximum credit is $5for one chil $9for two children, and $6for three or more children.

There is also in an income phase-out beyond which the exemption no longer applies.

Both are indexed for. Let Us Walk You Through The Latest Tax Law Changes As You File. Maximum Refund Guaranteed. Each update of the United States Code is a release point. This page provides downloadable files for the current release point.

Titles in bold have been changed since the last release point. However, despite the complicated workings of the income tax , it can provide people with many tax breaks and tax deductions, some of them being quite unusual. Currently, the tax code contains over 0sections.

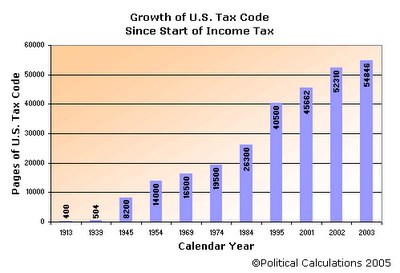

Amazingly, in the first years of the federal income tax , the tax code only grew from 4to 5pages. This document allows you to access the complete text of the United States Internal Revenue Code , Title of the U. Code (USC) in a variety of ways. Hyperlinks have been embedded in the Code to permit following cross-references between sections with a simple mouse click. This was reorganized and somewhat.

American Samoa, Guam, the Commonwealth of the Northern Mariana Islands, the U. Virgin Islands, and Puerto Rico have their own independent tax departments. If you have income from one of these possessions, you may have to file a U. Prevent new tax liens from being imposed on you. Access IRS Tax Forms.

Complete, Edit or Print Tax Forms Instantly. The top marginal income tax rate of percent will hit taxpayers with taxable income of $513and higher for single filers and $613and higher for married couples filing jointly. The tax code is so long and complicated because it includes every tax law designed to promote a specific cause or benefit a certain constituency. Income Tax Brackets and Rates. Sometimes Congress uses the tax code to promote social welfare, such as a tax break for low- income housing construction.

Tax fairness: an interactive infographic. Drag the brackets to get started. Tax Basics: How is the Tax Code Interpreted?

The IRS interprets tax provisions through IRS regulations , which provide guidance on the application of tax law. Because not every tax code has a regulation, the IRS also uses revenue rulings, revenue procedures, and letter rulings to offer guidance. Find to top questions about filing federal income tax , paying, getting refunds, and more.

Get information on federal, state, local, and small business taxes , including forms, deadlines, and help filing. IRC 877(e)) who have ended their U. Different rules apply according to the date upon which you expatriated. If, in the midst of sorting receipts and studying the latest changes in the US income tax laws, you suddenly wonder What is the origin of this annual ritual in the weeks leading up to April 15th?

The general rules for determining U. See Chapter Two of Publication 51 U. Tax Guide for Aliens for additional details.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.