Free for Simple Tax Returns. Maximum Refund Guaranteed. What are the corporate tax rates? The tax treaty rates apply only to corporate shareholders.

The applicable treaty should be checked for conditions required to claim the reduced rate. Note that WHT may be subject to the income surtax of 2.

KPMG’s corporate tax table provides a view of corporate tax rates around the world. The regular business tax rates vary between 0. The special local corporate tax rate is 414. For corporate tax , corporations are divided into two categories: domestic corporations and foreign corporations. Domestic corporations are defined as all corporations that have their head offices in Japan.

Also, subsidiaries of foreign corporations established in Japan are regarded as domestic corporations. Foreign corporations are those, which are not considered domestic, as well as branch. April and further trim it in coming years in a bid to spur business investment and growth.

Thanks to the withholding tax system, most employees in Japan do not need to file a tax return. Increase Your Tax Savings. Tax Tips for the Self-Employed. Find Out More About Your Taxes! Net profits remitted to foreign head office of branch subject to withholding tax.

Bahamas No income tax. As everyone knows by now, Japan ’s corporate tax rate is scheduled to be cut on April 1st, but there is considerable confusion on what that new rate is. A lot of this confusion stems from the different ways in which Japan ’s combined national and subnational rate is calculated. However, the US tax reforms currently under consideration are in stark contrast to Japan. The corporate tax rate reduction to does not come with mandates.

Meanwhile, there will be a top tax rate for pass-through entities such as limited liability corporations. The tax credit for the promotion of income growth and the tax credit for job creation may be taken in the same fiscal year, if certain adjustments are made. Important thing is that in Japan Local taxes (Inhabitant tax , Local corporation tax , Enterprise tax and Local corporation special surtax) are levied in addition to National corporation tax.

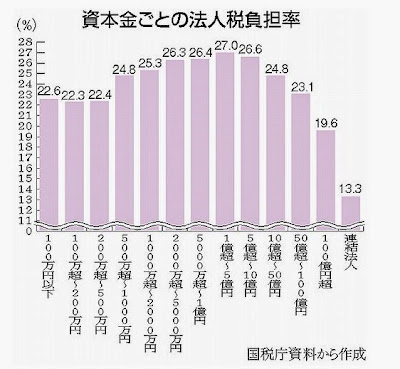

Companies established in Japan with share capital of JPY 1million or less are regarded as a Small and Medium sized Entity (“SME”) and are eligible for certain tax benefits (reduced corporate tax rate , partial deductibility of entertainment expenses, etc) under Japanese corporate tax law. Corporation income taxes in Japan. Industry-Specific Deductions.

Get Every Dollar You Deserve.

One-stop Solution for Doing Business in Japan. We provide a one-stop solution for doing business in Japan , so that you are able to concentrate on your own business efforts. Our main services are complicated Japanese tax compliance services, bookkeeping, reporting packages, payment services and payroll services. Tokyo Metropolitan on basis of capital.

Taxation in Japan Preface. Tax rates vary based on the corporate laws of each nation. This booklet is intended to provide a general overview of the taxation system in Japan.

The contents reflect the information available up to. If you have problems opening the pdf document or viewing pages, download the latest version of Adobe Acrobat Reader.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.